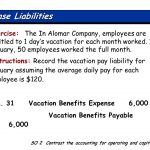

Payroll involves the payouts to a business’s employees, including benefits, salaries, taxes, garnishments, and other deductions. Companies will use payroll processing software to streamline the process or outsource the task entirely. Though many small businesses begin with the owner as the sole employee, it eventually becomes advantageous to hand over accounting functions to a professional.

How to calculate net income

The most critical factors in your decision on accounting software for your small business are determining which features you need and how much you’re willing to spend. Accountants can help take some of the pressure off tax season by handling the preparation and filing for you. If your business can afford to hire an accountant, doing so could save you time and potentially even tax dollars. Accounting consists of tracking financial transactions and analyzing what they mean for your business. The figures in your reports will look different depending on whether you use cash or accrual basis accounting. The IRS doesn’t require you to keep records of certain expenses under $75, but we still recommend that, to be safe, you keep digital copies of all records.

Step 3: Choose an accounting method

Even if your company has just one staff member, and especially if your business has multiple employees, accounting software is becoming a must-have for every business owner. The best accounting software can help you crunch the numbers, track the transactions, and balance the books. Accounting software can help a business manage finances more efficiently, prepare for tax filing, and provide a clearer sense of the company’s financial health and needs. You can choose from many accounting software systems with varying features and prices.

Net income formula explained

Business accounting also does not focus on long-term financial decisions but on internal tasks within the company. Some of the best small-business accounting software options include QuickBooks, Xero, and FreshBooks. Your team of financial professionals will need to be able to access prepaid expenses journal entry definition how to create and examples your books easily and with minimal risk of error. While accountants typically work with paid products like QuickBooks Online or Xero, they may be familiar with some of the free ones listed here, too. Your accounting needs might be modest today, but they may not stay that way forever.

Free business software can be the right choice if it covers your financial, payroll, inventory, sales or other needs. The best choice will depend on your specific industry, budget and growth trajectory. But if a free product doesn’t make it easier to run your business, a paid option will likely be the better choice to save you time and help ensure accuracy. You can usually opt for free trials of paid versions before committing to get a better idea of how user-friendly and capable the software is. NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business.

Compare the year’s best accounting software

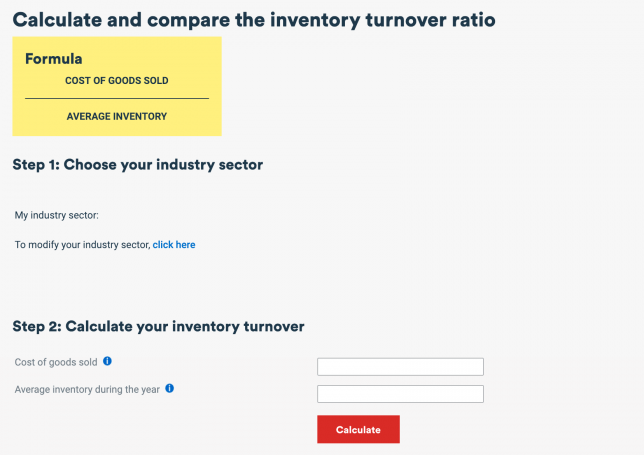

Accounting is the process of recording, classifying and summarizing financial transactions. It provides a clear picture of the financial health of your organization and its performance, which can serve as a catalyst for resource https://www.personal-accounting.org/accrued-hire-income-accountingtools/ management and strategic growth. When all of your transactions have been entered, you’re ready to run your financial statements. Start with an unadjusted trial balance, which can help locate any out-of-balance accounts.

You must use a double-entry accounting system and record two entries for every transaction. Small businesses may benefit from an accountant as the company grows, and the need for more financial tracking, recording, forecasting, and budgeting accrues. Bookkeeping involves the day-to-day administrative tasks of recording sales and financial transactions.

- Based on the nature of your business, you might decide to offer credit to customers.

- For established businesses, accounting firms’ hourly rates can become exorbitant as transactions become more complex.

- Business owners should be able to enter transactions, reconcile accounts and interpret financial statements accurately.

- Whether you’re starting a brand-new business or you have some experience under your belt, creating a solid accounting plan can help you monitor and maintain your financial health.

- You can look at these documents yourself or collaborate with a financial professional to analyze the state of your business’s finances.

It’s also a good place to store money you’re setting aside for taxes and unforeseen emergencies. Make sure you compare a few options—and take note of requirements such as maintaining a minimum balance—before settling on a bank. Finally, if you are using Shopify, you can simply use Shopify Payments to receive credit card payments. Depending on your Shopify plan, you’ll have to pay between 2.4% and 2.9% in fees for receiving credit card payments. Luckily, you can use online software like Deskera to automate tax calculation for payroll and manage all of your payroll payments through an easy-to-use visual dashboard.

I still do a shocking amount of bookkeeping, invoicing, and other financial tasks for my business with manual spreadsheets and processes. But I’m a solopreneur/freelancer, and so my business finances are easy to manage. If you have a solo business https://www.quickbooks-payroll.org/ like me, it might feel «good enough» (for now) to manually track your own numbers and make your own spreadsheets to share with your accountant at tax time. Xero offers pricing plans to suit businesses of different sizes and stages.

When creating an invoice, the software automatically creates the journal entry and maps it to the relevant accounts (accounts receivable, sales, etc.). If you decide to outsource your small business accounting to a contractor or external firm, then you’d still be paying several hundred or thousand dollars a month. These are the 10 steps you need to follow in order to successfully do accounting for your small business. Below, you’ll find some frequently asked questions that small business owners have when it comes to accounting. In North America for example, the preferred payment method is credit cards – with around 34% of payments being carried out with a credit card.

How a company chooses to record transactions depends on the business owner. However, for government regulations and tax purposes, it is wise to always keep track of everything, including receipts and invoices. However, working with a CPA offers many benefits for LLCs and corporations. CPAs can analyze bookkeeping records, help with payroll and taxes, offer financial consulting, and represent you during IRS audits. Common accounting programs for small businesses include QuickBooks, Xero, and FreshBooks. Each platform offers powerful features for small business owners, including bookkeeping tools, point-of-sale functions, and mobile apps.

Once you understand some of the steps to take for effective, accurate business accounting, take the initiative and learn key skills in business accounting. Business accounting differs from other types of accounting in a few ways. One significant way this type of accounting differs from other accounting methods, like financial accounting, is that there are no compliance regulations.

Their job is to manage bills, payroll, invoicing, and transactions with suppliers. Most bookkeepers monitor cash flow, create budgets, and manage accounts payables and receivables. Accountants can ensure your financial reports are accurate and optimized, so you can minimize taxes, increase cash flow, and grow your business. It’s especially helpful to have an accountant to help you prepare tax returns or any other type of government form.